colorado paycheck calculator hourly

Colorado Hourly Paycheck Calculator. Federal Hourly Paycheck Calculator.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Then multiply that number by the total number of weeks in a year 52.

. These calculators are not intended to provide tax or legal. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Try PaycheckCity Payroll for free.

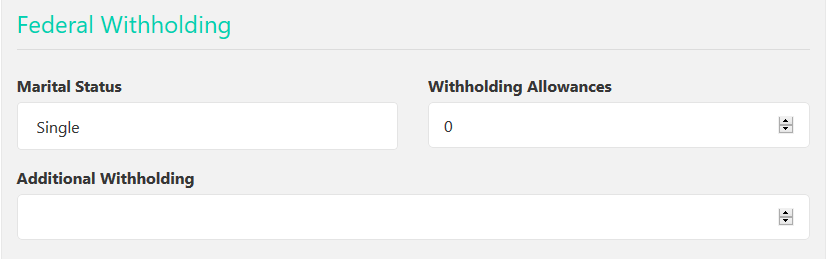

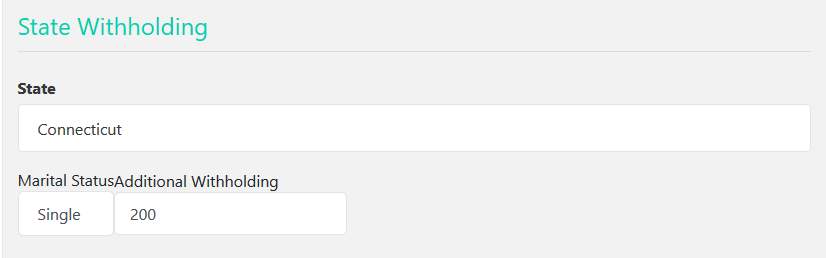

For 2022 the Unemployment Insurance tax range is from 075 to 1039 with new employers generally starting at 17. Details of the personal income tax rates used in the 2022 Colorado State Calculator are published below the. Computes federal and state tax withholding for paychecks.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 303-860-4200 option 3 Toll-free. B Daily wage GP WPD.

The calculator on this page is. Important Note on the Hourly Paycheck Calculator. Colorado Overtime Wage Calculator.

Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Lets be honest - sometimes the best gross profit margin calculator is the one that is easy to use and. Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Helpful Paycheck Calculator Info. This Colorado hourly paycheck calculator. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

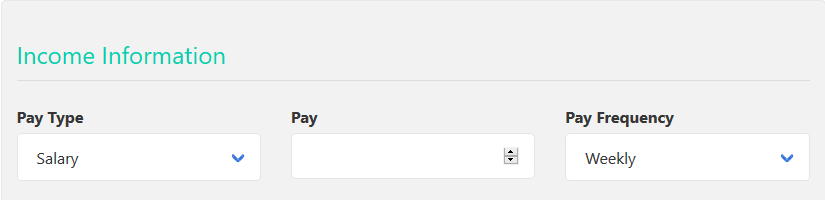

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The results are broken up into three sections. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Supports hourly salary income and multiple pay frequencies. Your paycheck might have a very different impact on your budget if youre forced to work around the clock to earn it. A Hourly wage is the value specified by the user within GP.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only. Below are your Colorado salary paycheck results. Use the Colorado dual scenario hourly paycheck calculator to compare two hourly paycheck scenarios and see the difference in taxes and net pay.

Important Note on Calculator. Colorado has a straightforward flat income tax rate of 455 as of 2021. Multiply the hourly wage by the number of hours worked per week.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

Switch to Colorado salary calculator. Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H. Or Select a state.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Learn how much should you be paid in 2022. Switch to Colorado hourly calculator.

It should not be relied upon to calculate exact taxes payroll or other financial data. The Paycheck Calculator may not account for every tax or fee that. Colorado Hourly Paycheck and Payroll Calculator.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. In Colorado overtime hours are any hours over 40 worked in a single week or any hours worked over 12 in a single day. Now is the easiest time to switch your payroll service.

For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. - In case the pay rate is hourly.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. Use our easy payroll tax calculator to quickly run payroll in colorado or look up 2022 state. It changes on a yearly basis and is dependent on many things including wage and industry.

Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. It is not a substitute for the advice of an accountant or other tax professional.

Free paycheck calculator for both hourly and salary employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Colorado State Income Tax Rates and Thresholds in 2022. Make running payroll easier with Gusto.

And if youre in the construction business unemployment taxes are especially complicated. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. Colorado Hourly Paycheck Calculator Results.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Colorado Unemployment Insurance is complex. This free easy to use payroll calculator will calculate your take home pay.

Fill in the employees. Colorado Salary Paycheck Calculator.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Primepay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Colorado Paycheck Calculator Adp

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Salary To Hourly Salary Converter Salary Finance Hour

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee

Colorado Paycheck Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Paycheck