are 529 contributions tax deductible in south carolina

In fact South Carolina is one of six states where you can still make a contribution to the state administered 529 plan Future Scholar and claim a deduction for the prior tax year up until you file your tax return. Most 529 plans allow participants to deduct part or all of their contributions on their income taxes and contributions to the SC Future Scholar.

Hanes Hall Unc Chapel Hill Unc Chapel Hill College Counseling Campus

When you withdraw money to pay for qualified expenses you pay no South Carolina state.

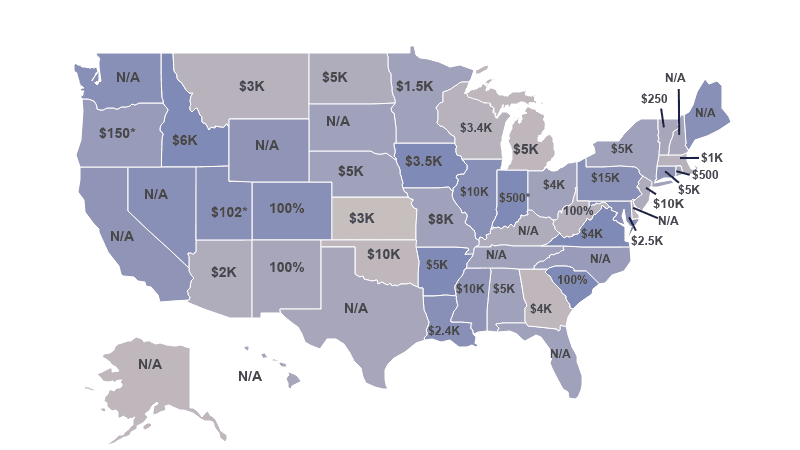

. In your South Carolina return look for the screen Heres the income that South Carolina handles differentlyThe Education section should be right below RetirementSee Screenshot 1 belowIf you do not see the Education section there look up under the screen title. If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages. 36 rows Most states limit the amount of annual 529 plan contributions eligible for a state income tax.

Families should note that while the federal government does not reward 529 contributions it does penalize early withdrawals. South Carolina taxpayers can deduct 100 of their contributions on their state tax returns. State Treasurer Curtis Loftis kicked off the upcoming National 529 College Savings Day by announcing that South Carolinas Future Scholar 529 College Savings Plan will provide privately-funded 529 grants to every baby born in South Carolina on May 29 2022.

For most taxpayers there is no requirement to hold funds in a 529 plan for a specified amount of time before claiming a state income tax benefit. Tax Benefits of 529 College Savings Plans. Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution.

There is no time in which the funds within a South Carolina 529 plan need to be withdrawn. Good news for South Carolina residents by investing in your states 529 plan every dollar contributed can be deducted from your adjusted gross income. This year the PalmettoBaby Grant Program will celebrate a decade of collaborating with hospitals across the.

Withdrawals from a 529 plan are exempt from taxes when funds are used for qualified expenses such as tuition books housing food computers and supplies. Future Scholar account contributions may be tax-deductible up to the maximum account balance limit of 52000 0 per beneficiary or any lower limit under applicable law. This means that South Carolina taxpayers can deduct any amount they contribute to an SC 529 plan as long as they have the income to deduct.

Vermont taxpayers who contribute to the 529 plan are eligible for a state income tax credit of 10 of the first 2500 put into the fund 250 per beneficiary. 5 tax credit on contributions up to 4080 for joint accounts. If you invest 1000 and earn 5 during a year youre not taxed on the 50 you earned.

The 1099-Q for the 529 plan deductions is entered in Deductions and Credits. You can contribute up to 15000 per year 30000 for married couples. Is a 529 plan tax deductible in the state of New Jersey.

Married couples who are filing jointly can also receive the same tax credit for the first 5000 in contributions 500 per beneficiary. But you may be wondering if you can also get a 529 tax deduction. For example if you contribute 5000 to a 529 plan then you must first pay taxes on the contribution before you invest it.

Out-of-state participants still get the federal tax benefits. 529 plan accounts accept only cash contributions so assets in a Coverdell account must be liquidated first to make the transfer. Contributions to a South Carolina 529 plan are fully deductible - no limit.

Only three other states allow for 100 of contributions to be claimed. Yes you read that correctly. There is no indication that this rule will change anytime soon.

Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for education. Georgia Iowa Mississippi Oklahoma and Wisconsin are the others. Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

While no federal tax break exists for deducting 529 plan contributions you may be able to claim a deduction or tax credit at the state level. 4 rows New Jersey offers tax benefits and deductions when savings are put into your childs 529. Yes south carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution.

In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax. South Carolina only allows residents to participate in their plans. What happens to a South Carolina 529 Plan if not used.

The growth of your account isnt taxed either. 3439 single 6878 joint beneficiary. The maximum aggregate contribution limits vary by state.

This means that the contributions made to a 529 plan are taxed at the federal level without any federal income tax deduction. Here are the special tax benefits and considerations for using a 529 plan in South Carolina. Contributions to a single beneficiary across all 529 accounts cannot exceed 520000.

If youve opened the Education screen before it may appear at the top for easy reference. Contributing to a 529 college savings account can offer tax advantages including tax-deferred growth and tax-free withdrawals for qualified education expenses. You have until May 17 2021 to contribute and still get a break on your 2020 tax bill if you file a South Carolina tax return.

You also get federal income tax benefits as you do not pay income tax on your earnings. There is no minimum contribution. Here are thedirections for 1099-Q.

While more than 30 states including the District of Columbia offer some sort of state income tax deduction for qualifying 529 plan contributions South Carolina is just one of six that allows families to claim a prior-year tax deduction up until the tax filing deadline. New Mexico Virginia and West Virginia. Unfortunately the federal government does not allow families to deduct contributions to a 529 plan.

Full amount of contribution. Since contributions can add up to 500000 per beneficiary thats a high threshold. New Jersey does not provide any tax benefits for 529 contributions.

New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an. South Carolina residents who contribute to the states 529 plan receive an unlimited state income tax deduction. There can even be multiple accounts for the same child as long as all combined contributions across these accounts do not exceed 520000 in South Carolina.

Solved Where Do I Enter My 529 Contributions For South Ca

Where Do I Enter Contributions To A 529 Plan For T

Can You Get A 529 Plan Tax Deduction

South Carolina 529 Plans Learn The Basics Get 30 Free For College

529 Plans Which States Reward College Savers Adviser Investments

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start

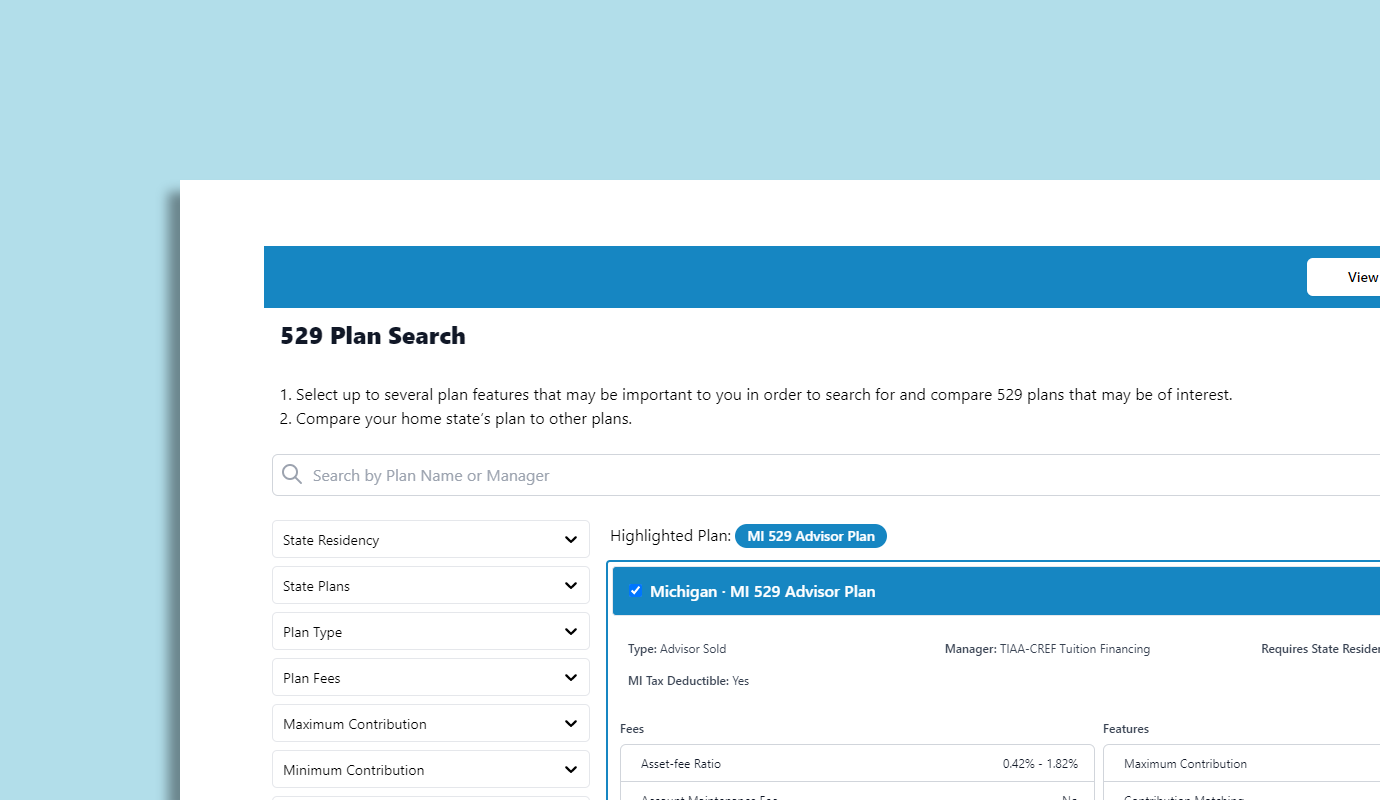

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

529 Plans Which States Reward College Savers Adviser Investments

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Visa Versus Mastercard Versus American Express Does It Matter Credit Score Apply For A Loan American Express

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Tax Benefits By State Invesco Invesco Us

529 Tax Deductions By State 2022 Rules On Tax Benefits

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

The News Is Here Accountfully Has Expanded Its Services Tools And Resources To Better Serve Financial Information Bookkeeping And Accounting Press Release